> FINANCES

Financial Transparency

The Texas Comptroller of Public Accounts has developed standards for local governments to provide online financial transparency. This section summarizes the most requested financial information about North Central Texas College.

For more information, visit Texas Comptroller Financial Transparency.

Investments

North Central Texas Community College District (NCTC):

Does not employ outside investment advisers or managers.

Does not use soft dollar, directed brokerage, or directed commission, commission recapture, or similar arrangements.

NCTC is associated with the North Central Texas College Foundation. The market value of the foundation’s investments at August 31, 2023 was $13,691,420.

Contact Information for the Foundation:

Debbie Sharp

1525 W California Street

Gainesville, TX 76240

(940) 668-3305

Investment Policies

NCTC Investment Reports

Fiscal Year 2024-2025

Other Financial Information

Traditional Finances Summary For 2022

Traditional Finance Summary for the most recent fiscal year that ended on 8/31/2022.

Total Expenditures — $68,538,261 (Per Student* $5,409)

Total Revenues — $769,640,651 (Per Student $5,496)

Total Revenues from Property Taxes — $4,500,945 (Per Student $355)

Full Time Equivalency (All Personnel) — 522

Full Time Equivalency (Students**) — 4,025

*Per Student calculations based on 11,333 unduplicated students for 2021-2022 credit enrollment.

**FTE Students is based on Fall 2021 credit enrollment.

Historical Tax Rates per $100 Valuation

Maintenance/Operations

2019 = 0.0808

2020 = 0.0757

2021 = 0.0728

2022 = 0.0731

2023 = 0.0642

Interest/Sinking (Debt)

2019 = 0.0294

2020 = 0.0256

2021 = 0.0250

2022 = 0.0218

2023 = 0.0209

Combined Tax Rate

2019 = 0.1102

2020 = 0.1013

2021 = 0.0978

2022 = 0.0949

2023 = 0.0851

5-Year Trend of Revenues/Expenditures Per Student

Revenues Per Student*

2017-2018 — $3,418

2018-2019 — $3,399

2019-2020 — $4,463

2020-2021 — $5,913

2021-2022 — $6,145

Expenditures Per Student*

2017-2018 — $3,383

2018-2019 — $3,727

2019-2020 — $4,508

2020-2021 — $4,901

2021-2022 — $6,048

Total Revenues

2017-2018 — $55,363,627

2018-2019 — $55,463,729

2019-2020 — $64,026,649

2020-2021 — $74,922,161

2021-2022 — $69,640,651

Total Operating Expenses

2017-2018 — $54,795,727

2018-2019 — $60,830,410

2019-2020 — $64,675,228

2020-2021 — $62,099,353

2021-2022 — $68,538,261

*Unduplicated, 12 mos, students

2017-2018 — 16,196

2018-2019 — 16,320

2019-2020 — 14,346

2020-2021 — 12,671

2021-2022 — 11,333

5-Year Trend of Tax Rates per $100 Valuation

Maintenance/Operations

2018-2019 — 8.08

2019-2020 — 7.57

2020-2021 — 7.28

2021-2022 — 7.31

2022-2023 — 6.42

Interest/Sinking (Debt)

2018-2019 — 2.94

2019-2020 — 2.56

2020-2021 — 2.50

2021-2022 — 2.18

2022-2023 — 2.09

Combined Tax Rate

2018-2019 — 11.02

2019-2020 — 10.13

2020-2021 — 9.78

2021-2022 — 9.49

2022-2023 — 8.51

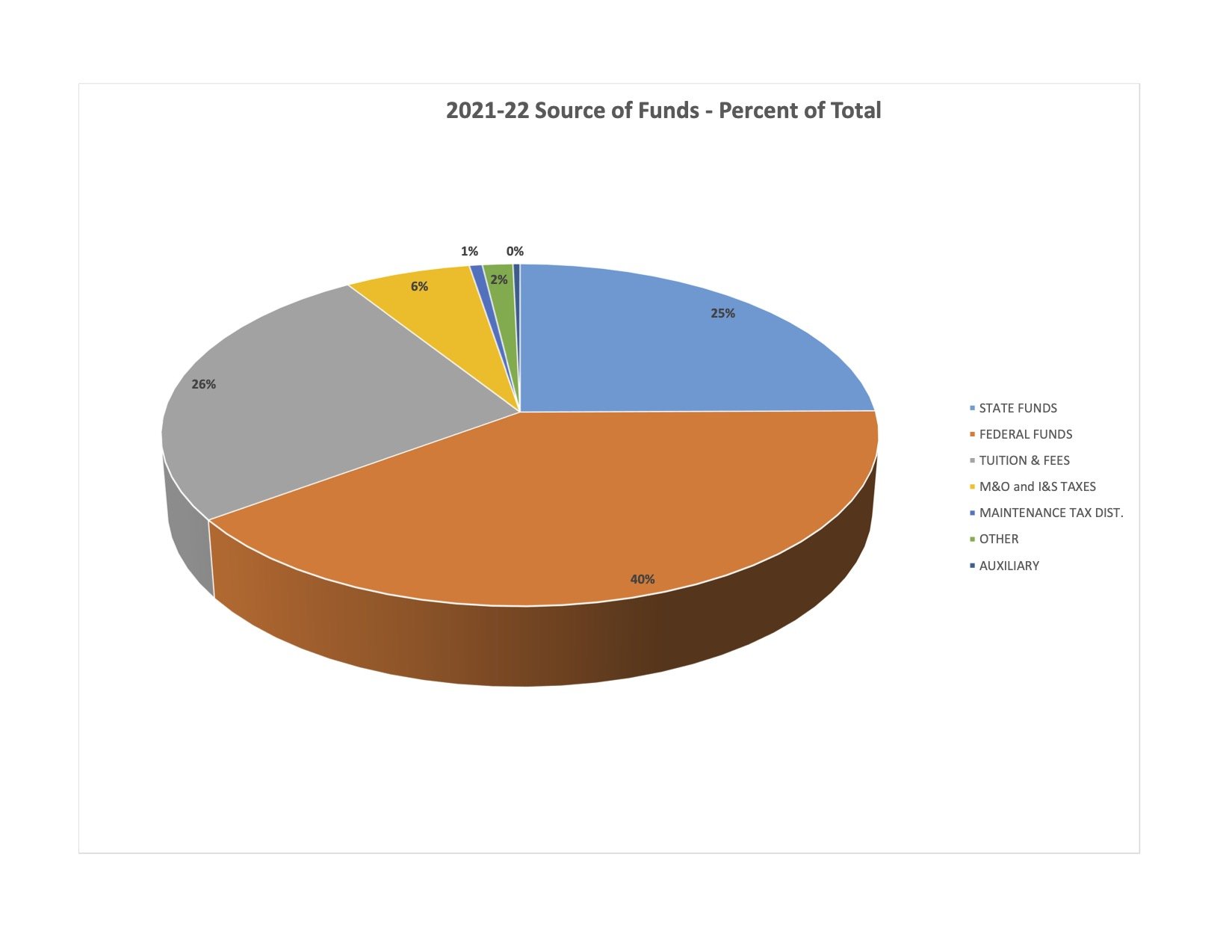

Comparison of Source of Funds 2020-2021 to 2021-2022 (in dollars)

State Funds

2020-2021 — $17,232,611

2021-2022 — $17,327,435

Difference — $94,824

2020-2021 % of Total — 23.00%

2021-2022 % of Total — 24.88%

% Increase or Decrease — 0.55%

Federal Funds

2020-2021 — $23,992,240

2021-2022 — $27,885,353

Difference — $3,893,113

2020-2021 % of Total — 32.02%

2021-2022 % of Total - 40.04%

% Increase or Decrease — 16.23%

Tuition & Fees

2020-2021 — $20,844,482

2021-2022 — $18,119,617

Difference — $(2,724,865)

2020-2021 % of Total — 27.82%

2021-2022 % of Total — 26.02%

% Increase or Decrease — (13.07%)

M&O, I &S Taxes

2020-2021 — $4,211,464

2021-2022 — $4,500,945

Difference — $289,481

2020-2021 % of Total — 5.62%

2021-2022 % of Total — 6.46%

% Increase or Decrease — 6.87%

Maintenance Tax District

2020-2021 — $427,475

2021-2022 — $461,330

Difference — $33,855

2020-2021 % of Total — 0.57%

2021-2022 % of Total — 0.66%

% Increase or Decrease — 7.92%

Other

2020-2021 — $8,019,208

2021-2022 — $1,094,535

Difference — $(6,924,673)

2020-2021 % of Total — 10.70%

2021-2022 % of Total — 1.57%

% Increase or Decrease — (86.35%)

Auxiliary

2020-2021 — $194,681

2021-2022 — $251,436

Difference — $(56,755)

2020-2021 % of Total — 0.26%

2021-2022 % of Total — 0.36%

% Increase or Decrease — 29.15%

Grand Total

2020-2021 — $74,922,161

2021-2022 — $69,640,651

Difference — $(5,281,510)

2020-2021 % of Total — 100%

2021-2022 % of Total — 100%

% Increase or Decrease — 7.05%

Comparison of Use of Funds 2020-2021 to 2021-2022 (in dollars)

Instruction

2020-2021 — $21,045,398

2021-2022 — $21,096,877

Difference — $(51,479)

2020-2021 % of Total — 33.89%

2021-2022 % of Total — 30.78%

% Increase or Decrease — (0.24%)

Public Service

2020-2021 — $1,442,750

2021-2022 — $1,296,164

Difference — $(146,586)

2020-2021 % of Total — 2.32%

2021-2022 % of Total — 1.89%

% Increase or Decrease — (10.16%)

Academic Support

2020-2021 — $4,058,940

2021-2022 — $3,946,512

Difference — $(112,428)

2020-2021 % of Total — 6.54%

2021-2022 % of Total — 5.76%

% Increase or Decrease — (2.77%)

Student Services

2020-2021 — $9,609,840

2021-2022 — $10,779,742

Difference — (1,169,902)

2020-2021 % of Total — 15.47%

2021-2022 % of Total — 15.73%

% Increase or Decrease — (12.17%)

Institutional Support

2020-2021 — $10,750,005

2021-2022 — $12,546,377

Difference — $1,796,372

2020-2021 % of Total — 17.31%

2021-2022 % of Total — 18.31%

% Increase or Decrease — 16.71%

Plant Operation/ Management

2020-2021 — $4,950,995

2021-2022 — $4,909,394

Difference — $(41,601)

2020-2021 % of Total — 7.97%

2021-2022 % of Total — 7.16%

% Increase or Decrease — (0.84%)

Scholarships/ Fellowships

2020-2021 — $7,281,257

2021-2022 — $9,379,133

Difference — $2,097,876

2020-2021 % of Total — 11.73%

2021-2022 % of Total — 13.68%

% Increase or Decrease — 28.81%

Auxiliary Enterprises

2020-2021 — $548,969

2021-2022 — $794,221

Difference — $245,252

2020-2021 % of Total — 0.88%

2021-2022 % of Total — 1.16%

% Increase or Decrease — 44.68%

Depreciation

2020-2021 — $2,411,199

2021-2022 — $3,789,841

Difference — $1,378,642

2020-2021 % of Total — 3.88%

2021-2022 % of Total — 5.53%

% Increase or Decrease — 57.18%

Grand Total

2020-2021 — $62,099,353

2021-2022 — $68,538,261

Difference — $6,438,908

2020-2021 % of Total — 100%

2021-2022 % of Total — 100%

% Increase or Decrease — 10.37%

Downloadable Annual Budgets

Budget 2023-2024.

Budget 2021-2022.

Budget 2020-2021.

Budget 2019-2020.

Budget 2018-2019.

Budget 2017-2018.

Budget 2022-2023.

Contact us.

NCTC Financial Services

1525 W. California Street

Gainesville, TX 76240

(940) 668-7731

Fax: (940) 668-3320

Contact Information for NCTC Board of Regents

Karla Metzler, Chair

kmetzler@nctc.edu

Christy Morris, Vice-Chair

cmorris@nctc.edu

Dillon Ott, Secretary

dott@nctc.edu

Jon Grime

jgrime@nctc.edu

Jerry Henderson

jdonhenderson@nctc.edu

Erica Sullivan

esullivan@nctc.edu

Lisa Bellows

lbellows@nctc.edu